کسب و کار کشاورزی در ایران - سه ماهه اول 2015

BMI Industry View

BMI View: Financial sanctions designed to pressure Tehran over its nuclear programme are playing havoc with Iran's ability to import goods. Food price inflation is soaring, leading to a serious decrease in meat consumption. The use of barter in place of regular trade can be seen as a feasible, albeit temporary, way of circumventing sanctions to meet demand. Although President Hassan Rouhani, who is more moderate than his predecessor Mahmoud Ahmadinejad, will most likely adopt a more conciliatory stance with the West, many sanctions are expected to remain in place. Over the longer term, we believe that the continued

investment by the government to improve infrastructure - such as the improvement of irrigation systems - will help the country to turn away from its backward agrarian system and will yield results in terms of better-quality grains. We are especially upbeat in our outlook for grains and sugar production.

Key Forecasts

■ Wheat production growth to 2017/18: 6.5% to 14.7mn tonnes. Wheat yields are expected to improve owing to the modernisation of technology, including hardier grains variants, greater access to relevant inputs and a larger area of the country benefiting from new irrigation facilities.

■ Sugar consumption growth to 2018: 20.5% to 2.4mn tonnes. Sugar demand will be mainly driven by population growth.

■ Poultry production growth to 2017/18: 14.1% to 900,400 tonnes. Growth will be driven by domestic demand and the effects of increased investment.

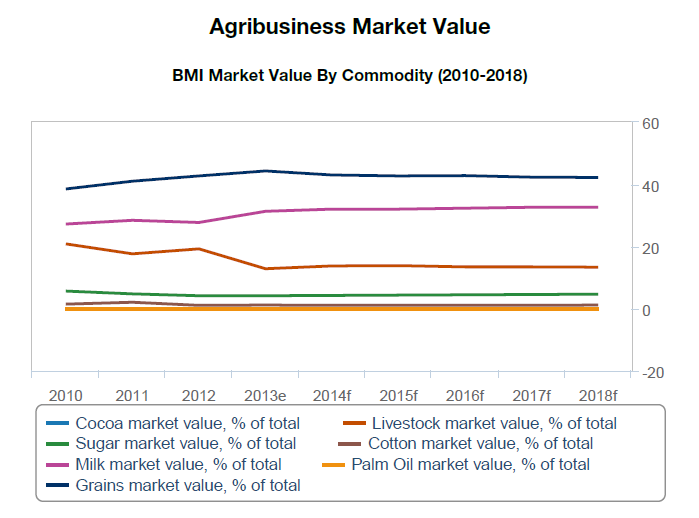

■ BMI Universe Agribusiness Market Value: USD47.2bn in 2014 (down 6.1% compared with 2013; growth forecast to average 1.1% annually between 2013 and 2018).

■ 2014 real GDP growth: 2.8% (up from -2.9% in 2013; predicted to average 3.1% from 2013-2018).

■ 2014 consumer price inflation: 23.0% year-on-year (y-o-y) (down from 35.6% y-o-y in 2013;

predicted to average 16.0% y-o-y from 2013-2018).

Key Developments

The outlook for Iran's livestock and dairy sectors in the short and medium term is improving. A recovery in farms' profitability will help production to grow in 2013/14 after two seasons of stagnation on the back of skyrocketing feed prices. In the medium term, the easing of sanctions is likely to boost Iran's economy, paving the way for substantial foreign investment that has been on hold. There has been recent progress in talks between Iran and Western countries to reach an agreement on the former's nuclear programme: Iran and the so-called P5+1 countries - China, France, Russia, the UK and the US plus Germany - on November

24 2013 reached an understanding on the implementation of a deal under which sanctions on some of Iran's trade in goods and services will be suspended.

The oil and gas industry, along with infrastructure, would be obvious beneficiaries; however, agribusiness projects, especially in the livestock and dairy sectors, also are likely to benefit from the easing of sanctions.

Large agribusiness companies are already present in Iran and most, such as Danone, entered the market before international sanctions were imposed in 2012.

Since the agreement, Iran has made a number of deals related to grain and fertilisers imports, which demonstrates that hurdles to imports are easing. In September 2013, Iran's Agricultural Support Services Company issued a tender to buy 60,000 tonnes of potassium sulphate, its first tender in two years. Belgian chemical firm Tessenderlo won this tender. In February, Iran bought at least 400,000 tonnes of wheat from Russia and the European Union in the first big state-sponsored purchase since December 2013. We believe private Iranian buyers are likely to make more active purchases this year as trade becomes easier in line with the easing of restrictions on Iran's banking system. The government stepped up state purchases in recent years in order to deal with rising hurdles to trade.

The aforementioned sanctions have also affected the rice industry, and Iran has been increasingly relying on Indian rice exporters since 2011. India was one of the few countries to have a barter trade system and other payment mechanisms with Iran, which helped India to import oil and export rice and other items to Iran. However, the recent progress in talks between Iran and Western countries to reach an agreement on the former's nuclear programme may weaken the Indian advantage by eventually allowing free trading in US dollars. This is likely to favour Thai and mostly Pakistani exports, as these countries are traditionally the largest suppliers to Iran.